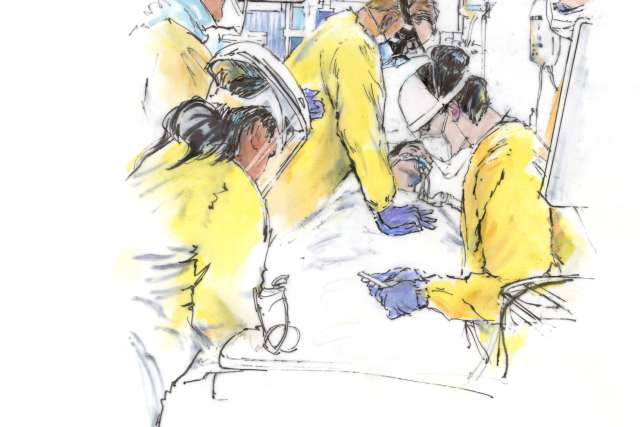

SINCE THE PANDEMIC BEGAN IN 2020, we have heard daily reports about the impact COVID-19 has had on patients, their families and frontline health care workers. The human toll of the pandemic has, indeed, been devastating; in May, the COVID-19 ticker officially rolled over on 1 million deaths in the United States.

The pandemic also has taken a significant financial toll on our nation’s health care institutions. According to an April 2022 analysis of the financial health of California’s hospitals by the respected management-consulting firm Kaufman Hall, 51% operated in the red in 2021, and 55% had unsustainable margins. All told, in the second year of the pandemic financial losses to the state’s hospitals totaled nearly $6 billion. That eye-popping sum is nearly three times previous projections. And while federal support to hospitals offset some of that loss, the remaining losses still came to approximately $3.7 billion. On top of that, realized losses in the prior year topped $8.4 billion — a cumulative uncompensated loss of more than $12 billion over two years.

That number is just for hospitals in California; in another American Hospital Associationcommissioned Kaufman Hall report issued last year, the firm projected that the nation’s health care institutions stood to lose upward of $54 billion in 2021 alone, and the uncertain trajectory of the newly emerging variants “could result in even greater losses.”

The challenges are as serious for UCLA Health and its hospitals as they are for many other institutions across the state and nation. The financial losses represent staggering numbers, and their effects may linger for years into the future. The past two years have been marked by unprecedented volatility, and recent months of financial activity have not been as strong as we have historically seen over the past decade. While the approximate $100 million UCLA Hospital System received in federal CARES Act funding helped, it did not fully mitigate our operating losses

Yet, UCLA Hospital System is, in some ways, in a better position than many of our peer institutions. While the past two quarters have not been positive, the hospital system had a strong first quarter and remains positive on a year-to-date basis. We also took critical steps early in the pandemic to ensure that we would have adequate supplies to address disturbances to the supply chain. In addition, regulatory requirements were implemented by the state mandating that hospitals maintain minimum levels of PPE. Doing so was not without significant cost. Historically, we have operated on a “just-in-time” model — keeping sufficient inventory on hand with daily deliveries to meet our needs, but not stockpiling additional supplies to reduce the risk that medical items fall out of date, or even become obsolete. The pandemic changed that; global shortages and disruptions in distribution necessitated taking a different approach. Anticipating these changes, UCLA Health leased a 35,000-square-foot facility to store essential supplies. Having a warehouse meant the hospital system needed to implement a sophisticated inventory-management system and invest in skilled resources to run it. The price tag to move to this new model has been in the millions.

Going forward, the outlook for all hospitals is further complicated by current fiscal realities that are having an impact on every sector of the national economy. For example, the Federal Reserve Board in May increased interest rates a half-percent — the biggest one-time hike the Fed has made in more than 20 years. National inflation is currently at 8.5%, the highest rate we’ve seen in 40 years. Gas prices are up 70%. Food prices are up 8.5%. These clearly are signs of unprecedented uncertainty in the economic landscape.

In addition to inflationary increases, we have continuously had to mitigate supply-chain challenges. While we now have plenty of masks, gloves and hand sanitizer — items that all were in short supply in the early stages of the pandemic — we continue to see supply shortages in other necessary medical products.

The Kaufman Hall report highlights additional issues for California’s hospitals. According to its findings, supply expenses are up nearly 20%, drug expenses are up 41% and purchased or outsourced services are up 14% from 2019, the year prior to the start of the pandemic. Taken together, total outlays for California’s hospitals rose 15% in 2021, outpacing the 11% national average. For California’s hospitals, that meant that margins were, on average, 26% lower than prior to the pandemic.

What to do going forward? One hears the word “resiliency” a lot in the health care industry, and it is something to which we’ve given a good deal of thought. Undoubtedly, changes will need to be made to improve our financial situation. Such changes often involve growth — for which there are opportunities in the outpatient setting, but where bed limits present challenges in the inpatient setting — and/or curtailing expenses, generally through improving operating efficiencies. While establishing goals for operational improvement has been a routine part of our annual planning, much of that was put on hold during the pandemic to allow leadership to more narrowly focus attention on delivering critical health services. Now, as we come out of what we hope is the worst of the pandemic, we must again think strategically about these issues. But in so doing, we must be mindful of the impact such changes may have on our clinical staff, many of whom have been stretched thin over the course of the pandemic.

The trends are concerning and will need to be addressed as UCLA Health faces significant financial challenges. I anticipate that we will continue to be operating in an environment of fiscal constraint, especially as we continue to see inflationary increases above recent levels. Whatever choices we make in response to these pressures, they will be ones that adhere to our mission of delivering excellent patient care, conducting leading-edge research and educating the next generations of physicians and health care leaders.